With over 1 trillion online sales made around the world each year there is no surprise that eCommerce is a booming industry that most businesses aim to be a part of. Due to the desire to be a part of the online sales world, the creation of Payment Service Providers (PSP) was needed to become a payment link between business owners and their prospective customers. The most common payment methods through these applications are through credit card transactions, however each PSP offers differing services to fit their customer’s needs. The list below explain five of the most well known and upcoming PSPs. This list was capped at five, although there are a vast number of other PSPs that may have similar services and abilities.

Helpful Definitions:

HTML: Hypertext Markup Language, a standardized system for tagging text files to achieve font, color, graphic, and hyperlink effects on World Wide Web pages.

JavaScript: an object-oriented computer programming language commonly used to create interactive effects within web browsers.

API: application-programming interface, a set of programming instructions and standards for accessing a Web-based software application or Web tool. A software company releases its API to the public so that other software developers can design products that are powered by its service. Essentially a company’s code you can input into your site to provide their services.

NFC Payment: near field communication, is the technology that allows two devices, like your phone and a payments terminal, to talk to each other when they’re close together. NFC is the technology that enables contact less payments.

PayPal https://www.paypal.com/home

Features: As one of the most commonly known and used PSPs, over 179 million people use PayPal accounts while participating in the buying and selling of goods online. Having such a large number of users, and being responsible for a vast number of eBay monetary sales, PayPal may seem more credible than other PSPs because of the household name they have created for themselves. With a variety of services including accepting checks through smart phone images, card swipe technology, and online purchases made without even leaving the business’ site through PayPal upgrade, it is no wonder that PayPal has become so well known and used.

Cost: In order to receive payments this company does charge 2.9% plus an additional 30 cents on each sale that you make using their services. This application can be implemented into a website by inserting provided HTML code, to create a pay with PayPal button. Upgrade to PayPal pro for $30 a month for a checkout system where customers never leave your site. No termination fees.

Cards Accepted: PayPal has the ability to accept Visa, MasterCard, Discover, and American Express cards, while guaranteeing 100% protection against unauthorized payments. Meaning that you can always feel safe and secure when it comes to protecting your money.

The red arrow and box show where you can go to add and update payment buttons to or on your site.

Google Wallet https://www.google.com/wallet/

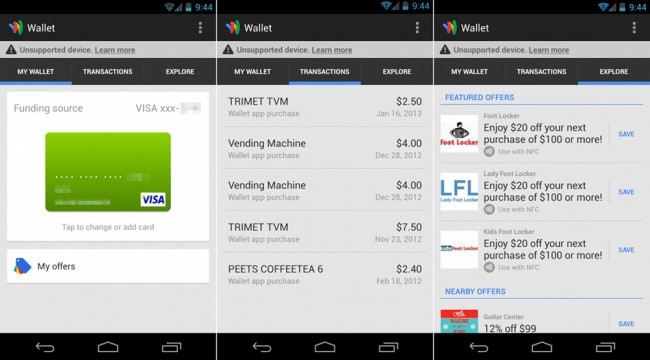

Features: Basically Google Wallet makes your phone into a wallet. This PSP, although reliable, only offers money transfers from one user to another using Google accounts. This could be an issue if you plan to use one of these services for an online shopping cart purpose. However, many people already have Google accounts which makes it a quick and easy process to transfer money from one person to another. With 24/7 fraud monitoring, covering 100% of all verified unauthorized transactions, people will feel safe using this software to transfer money and to pay for products and services. All private information is encrypted as well meaning that fraudulent activity is less likely to happen.

Cost: Free. If you withdraw money using your Wallet Card, some providers might charge an ATM fee. This fee will come out of your Wallet Balance, along with the total amount you withdraw.

Cards Accepted:This service has the ability to accept Visa, MasterCard, Discover, and American Express cards.

Google wallet smartphone user interface layout.

Square https://squareup.com/

Features: Square’s eCommerce API is a payment solution that allows you to accept credit and debit card payments from your own website. Square gives you the ability to connect your website with an eCommerce API application. This application will allow customers to securely make online purchases without ever leaving your website.

Cost: This service charges the standard fee of 2.9% plus an additional 30 cents on each successful purchase through your site. Square also offers unique services for in store sales, including chip card readers, NFC payment options, as well as the traditional magstripe readers. These are offered for both on the go services including readers that plug into mobile phones as well as more stationary services, such as a point of sales stand. Each of these products have a set sale price, for example the square card reader for smartphones costs $29.99 to own, and once purchase charge 2.75% on each purchase. Chargeback Protection is free for all Square merchants and covers eligible chargebacks up to a total of $250 a month.

Cards Accepted: All of these options including the online application encrypts transactions the moment the card is swiped or input into the system. This system has the ability to accept, Visa, MasterCard, Discover, and American Express cards.

Example of a on-the-go magstripe reader.

Amazon Payment https://payments.amazon.com/merchant

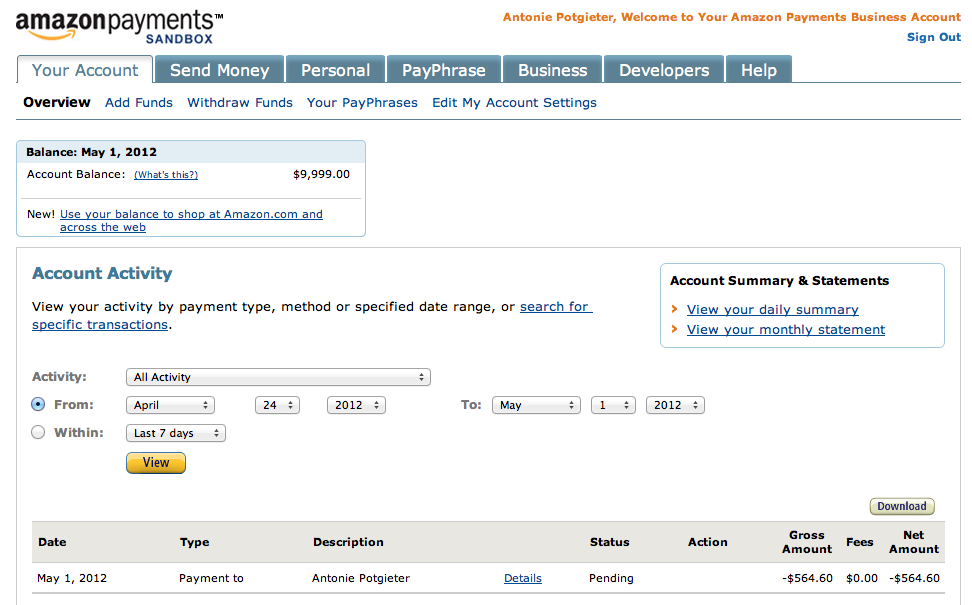

Features: Due to the large number of people who already use and trust Amazon, Amazon Payment makes it easy for customers to purchase items on your site using their already created Amazon profile. Each purchase is covered by the A-to-Z Guarantee issued by Amazon to ensure customers receive their products in the proper condition as well as in a timely manner (see amazon.com A-to-Z Guarantee information on their site), as well has a high level of fraud detection software. This service, like most of Amazon services, is simple to use and involves a free registration for and a simple integration of HTML and JavaScript code that the company provides for registered individuals. These codes can be implemented through an express route or through API integration. The only prior requirement to use this application, like many of the other PSPs, is an eCommerce platform already integrated into the site.

Cost: This service charges the standard fee of 2.9% plus an additional 30 cents on each successful purchase through your site. There are also no monthly fees, set-up fees, fraud protection fees or cancellation fees.

Cards Accepted: Amazon Payment has the ability to accept any card that Amazon.com accepts including, Visa, Amazon.com Store Card, MasterCard/EuroCard, Discover Network, American Express, Diner’s Club (U.S. billing addresses only), JCB, and NYCE cards.

Example of Amazon Payments account screen and options.

Stripe https://stripe.com/

Featured: Stripe is made for web developers who wish to integrate a payment system through a vast suite of APIs. Thousands of small companies and businesses use these plugins to accept and manage online payments, as well as edit how their specific sites checkout window will appear to their customers. Stripe also offers other services including subscriptions for monthly or weekly billing to customers or subscribers and the ability to accept bitcoin, meaning that they can accept payments from anyone anywhere. They also have a service in regards to disputes that you may face involving monetary transactions and purchases.

Cost: For a fee of 15 dollars the company will send any paperwork and or evidence pertaining to your issue for you to present for legal viewing. If you happen to be the winner of the dispute you will get refunded the 15 dollar paperwork fee as well as get your money back. Like the other PSPs this application does charge the 2.9% plus an additional 30 cents on any transaction completed (sale). No setup, monthly or hidden fees.

Cards Accepted: Stripe has the ability to process and accept, Visa, MasterCard. American Express, Discover, JCB, and Diners Club cards.

Stripe’s main user interface screen.

Authorize.net http://www.authorize.net/

Features: An Authorize.Net Payment Gateway account allows you to accept credit cards and electronic checks from websites and deposit funds automatically into your merchant bank account. Our solutions are designed to save time and money for small- to medium-sized businesses. Manage and review transactions, configure account settings, view account statements, download reports, and more through a password-protected website: the Merchant Interface. Accepting credit cards directly on your site assures customers that you have an established business. Control the look of your checkout page to reinforce your company’s brand, either on your own site or by using our custom hosted payment form. The payment gateway offers many features and options that can be tailored to specific merchant business models.

Cost: This service charges the standard fee of 2.9% plus an additional 30 cents on each successful purchase through your site. There is also a $49 set up fee and a $25 monthly gateway fee. All additional fees are free.

Accepted Cards: Authorize.net has the ability to process and accept, Visa, MasterCard. American Express, Discover, JCB, and Diners Club cards. Also accepts Apple Pay and PayPal accounts.

How Authorize.net handles transactions.

Summary Table:

[table id=1 /]

Conclusion

It is important to remember that no online process involving money is completely foolproof, and there is always a potential threat of fraudulent activity occurring even with the security systems and fraud protection that these PSPs contain.

Sources:

http://www.awwwards.com/18-online-payment-services-and-systems.html

http://www.navegabem.com/paypal-information.html

https://www.searchenginejournal.com/